A Tax Post: A Warning

This one ain't for the tax pros.

I don't actually like Ghost, and I know I moved everybody, but I'm looking at other alternatives. They don't even allow footnotes! Substack allowed footnotes (but they platform Nazis, and while this is my little bit of push back, a micro-protest in a sea, it's mine (and that's really important to remember when fighting fascism--your little bits all count. Still choosing to remember that laws exist and even if they decide they don't, you do. Not buying the narrative. Reading books. If you can, sending funds to bail bonds groups in LA or abortion groups. Even the good ole ACLU. You don't have to be Luke Skywalker. A mountain is made of small rocks)

Ok, so outside of that rant: if you know a Substack or Ghost alternative, please let me know.

Secondly, I know this is a blog dedicated to writing, but I work in taxes, man. It sounds terrible, doesn't it?

It's really not. I like helping people navigate this labyrinth. I've talked about how taxes are emotional work in other posts. I think this year has been a terrible year for good tax professionals. Ones with ethics who are concerned about how this administration is going to pillage data and use it for their own, nefarious means.

But this post is about the One Big Beautiful Bill. It's big alright but its not beautiful, its full of bullshit. There's a lot of chatter about how it will hurt people, but I want to focus on a few very specific things.

- The cuts in credits for low income and working Americans

- The use of the bill to assist wealthy Americans keep their wealth

- How this bill will hurt states and how that will raise your taxes

Tax Credits

A tax credit is a credit given by the government that can pay down your taxes, and in some cases, be refundable.

Example: Child care credit (non-refundable)

You can get a credit for paying for child care. This credit comes after your tax amount is calculated. It can then pay part of your tax bill. The credit is limited and has many provisions.

Example: Child Tax Credit (CTC; potentially refundable)

You can get a credit of up to $2,000 for a children under 17 with a Social Security Number. This credit works in two parts. Like the child care credit, it can pay down your taxes. And, if it reduces your tax to $0, you can get some of it back as a refund, up to $1,400.

The bill proposes a couple of things.

- That both parents and children on the return have SSNs. Currently, only children need them.

- This means families with a non-resident spouse will lose money or who are waiting on immigration status or are undocumented, will lose tax credits.

- Graduate students here on non-working visas couldn't receive the credit either

- This could affect 4.5 million children.

2k isn't a lot to some people, but it can make a helluva difference. Our tax programs such as CTC and Earned Income Tax Credit (EITC) raise millions out of poverty and EITC is one of the most successful anti-poverty programs in the history of this country.

So of course the GOP wants to eliminate it.

They are bringing back pre-certification. This is an old provision of the EITC where people would need to certify through third party documentation that they are eligible for the credit. It was trialed back in W Bush's presidency, and rejected because it didn't weed out fraud, it kept people waiting for refunds, and required a robust IRS to administer.

Guess who cut a ton of IRS funding and personnel?

IRS already checks EITC for fraud. They freeze the refunds. During the Obama administration they passed laws requiring all returns with credits to be checked, and not allowing refunds with certain credits before Feb 15th. Yes, there is still fraud in the system, but its better than this.

This system would require people to prove their eligibility and someone at the IRS would need to review all the applications and approve it. Just an FYI, I have some client work pending at the IRS and they are estimating a year before they can even review it. Who is going to review this? How? In what time frame?

People could wait months to get money that they sorely need.

EITC helps all sorts of people. Individuals with small businesses that don't net a lot of money. Working Americans with children. Working Americans without children. During Biden's first year, they expanded EITC to seniors and they should do that again. (You must be between 25 and 65 for it currently; in 2021, you could be 19 and older and working).

Building barriers and stripping these credits will increase the burden on already debt strapped and income stressed working Americans.

Which is the goal of the bill to:

Assist Wealthy Americans in Keeping their Wealth

This bill continues the restructuring of the tax code to assist the wealthy and the passive income earners.

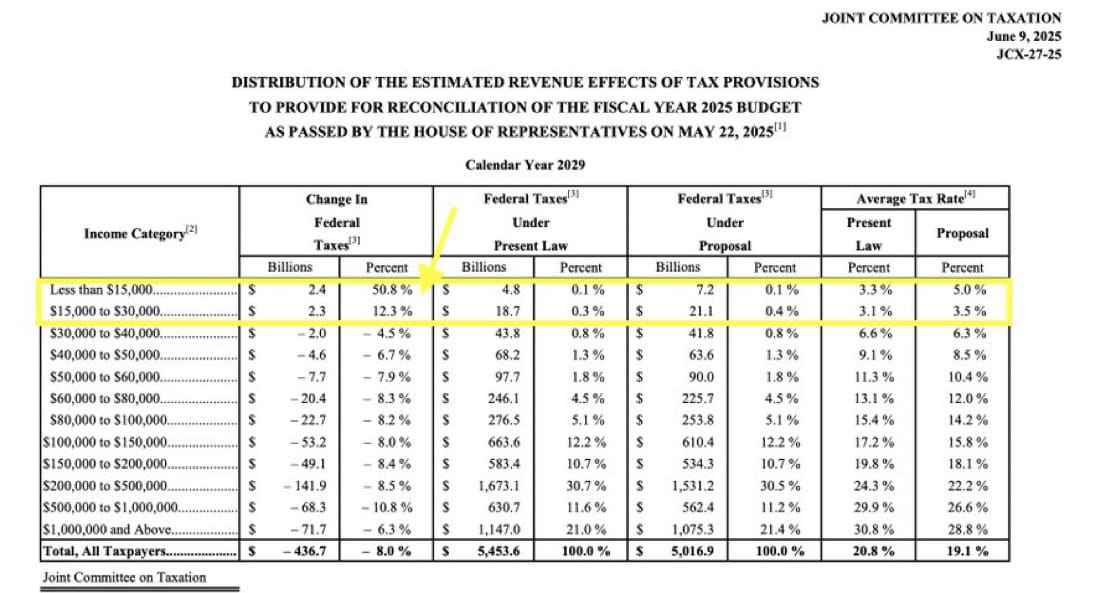

Examples of this include reducing the amount they have to pay in tax. The Joint Committee of Taxation in Congress has estimated that lower income Americans will pay more in tax than wealthy Americans. From ITEP:

Even foreign investors who own shares in U.S. companies would benefit more than the poorest fifth of Americans. These foreign investors would enjoy $23 billion in tax cuts in 2026 compared to just $4 billion for the bottom 20 percent of Americans.

You may have heard touting of the Trump bond where they give $1,000 to start a bond account. Except its not a bond account. They are not financially progressive, giving only $1,000 to families in restricted accounts (Harris wanted to give $6,000 to families who had a baby). This amount isn't enough to generate substantial wealth. True baby bond programs are publicly funded and instead these are tax savings vehicles for wealthy people to dump tax deferred income for their children to inherit.

Really, the correct thing to do is to allow parents to funnel funds into Roth accounts for kids without having the work requirement. And also increase the Child Tax Credit. And increase the age. After 17, it becomes $500. Anyways...

The bill also cuts charitable giving incentives to nonprofit groups, while increasing the tax benefits for donating to private K-12 schools.

It cuts down the benefit received donating to hospitals, children's charities, and veterans' associations.

It creates a tax shelter where wealthy Americans can funnel stock gifts into their kids' and grandkids' private schools without tax repercussions at the federal level (California will tax that, and currently does tax taking funds out of a 529 to pay for private K-12. Federal does not, up to 10k).

"The House tax plan would create a system that treats people supporting private K-12 vouchers far more generously than donors to children’s hospitals, veterans’ groups, and every other cause imaginable. While people making cash contributions to most causes would be barred from receiving more than 35 cents back for every dollar donated, cash contributors to private school voucher groups would be credited 100 cents on the dollar."

That above from this ITEP analysis of the bill.

The federal government would lose about 459 million in tax from this over 10 years. States would also lose tax funds. This also incentives the growing educational disparity, where public schools would be forced to fail and students would be thrust into private entities which are untested and, critically, do not have to accept disabled students (Many are bound by Section 504, but the Dept of Ed enforces that and guess which office they shuttered?) And that leads to the third part of my complaint:

States Would Need to Raise Revenue

One thing the OBB does is raise the State and Local Tax (SALT) cap. Currently, you can potentially only deduct up to $10,000 of property and local sales tax. This is only available to wealthy individuals, whose property interest payments, and charitable gains exceed their standard deduction (I'll explain below)

This has always hurt people in higher taxed blue states. The OBBB proposes to raise it to $40,000. Many states came up with a credit program to offset the SALT limit. Now it would be in limbo. Additionally, the bill cuts federal revenue going to states (already has done so through DOGE but even worse)

So, how will states, especially no tax states and low tax states, compensate for loss of income and loss of services? Well, they could just tell their constituents to fuck off, but eventually all those Midwest diner folks will become concerned about the lack of roads and failing public utilities.

States would need to raise their income taxes, sales tax, or property tax. Or all three.

Sales tax is a regressive tax. What that means is that lower income individuals pay a larger percentage of their income. Some states might start taxing food. Oregon, which doesn't have a sales tax, would need to increase their income tax, to the tune of about $900 a year more per taxpayer.

That's a lot of money. Especially as public utilities rise to fund AI wet dreams.

Most Americans will be financially crunched at every level.

Conclusion

Most Americans are going to end up having less in their pocket, thanks to this bill. Unless you are a millionaire. Heck, you might even lose your job. And thanks to all the other cuts in the bill, there will be less of an already small safety net to fall back on.

This doesn't include tariffs or other parts of the bill.

You can still call your senator and complain about this bill. Tell your friends and family. You can also email and fax them, if you don't want to call them. FaxZero is free.

If this interested you, please let me know and I can talk more about the tax provisions in this bill and how they affect Americans.

Note on deductions

When it comes to calculating your tax, not all income is taxed. Your income is reported, reduced by deductions, including either standard or itemized, to get to your income that is then taxed (taxable income). Your standard deduction is based on your filing status: single, married, head of household, etc. You get a standard deduction, no matter what*. However, you have an option to itemize. This is where your medical expenses, SALT taxes, mortgage interest, and charitable deductions go. If they exceed your standard deduction, you take the higher of the two.

Less than a third of Americans qualify for itemized since the Trump tax regime in 2018.

*again, it depends, especially for married filing separate folks.